A Gold IRA rollover allows you to take funds from an existing 401(k) or other retirement account and place them into a self-directed IRA designed for physical precious metals. Here’s how it works:

A Gold IRA is self-directed, which means you have control over which investments to include, unlike traditional retirement accounts managed by employers. This lets you decide on specific, IRS-approved gold products that best suit your retirement goals.

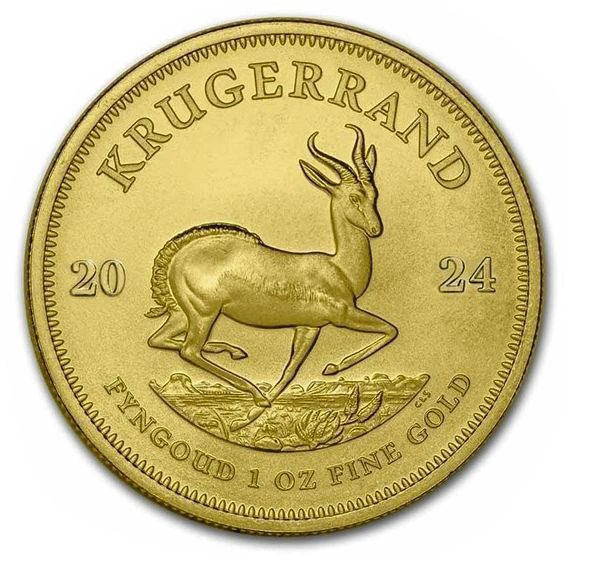

In a Gold IRA, you own physical, IRA-eligible gold assets. This can include gold coins or bars that meet IRS standards. Holding physical gold as part of your portfolio is different from investing in paper assets like stocks, offering you a stable, tangible investment.

By investing in gold through a rollover, you diversify your retirement savings. This diversification helps protect against market swings and economic downturns, making your retirement savings more resilient.

While each person’s financial situation is unique, there are several advantages to rolling over funds into a Gold IRA that many investors find beneficial:

A self-directed Gold IRA provides full control over your investments. Unlike traditional retirement accounts where choices are limited, a Gold IRA allows you to select specific gold products, offering personalized options that align with your financial goals.

Gold IRAs often come with lower management fees compared to other types of retirement accounts. Additionally, the long-term value of gold can help offset these fees, potentially making this investment more cost-effective over time.

With a Gold IRA, you have various options to choose from within precious metals, including gold coins and bars. This flexibility enables you to design a portfolio that meets your unique retirement objectives and risk tolerance.

The Gold IRA rollover process is penalty-free, as long as IRS guidelines are followed. This means you can transition your funds without additional taxes or penalties, preserving more of your savings and allowing them to grow in a gold-backed account.

In today’s uncertain economic climate, securing your retirement savings is more important than ever. Gold and other precious metals offer a stable foundation that protects against market volatility and inflation. Over time, gold has maintained its value, acting as a “safe haven” investment during times of economic downturn.

Adding gold to your retirement plan ensures a balance, as precious metals tend to perform well even when other assets fluctuate. By investing in gold, you are not just preparing for retirement—you are safeguarding your financial future against potential market changes.