If you’re ready to invest in gold coins, our team is here to help. Call us directly at (949) 861-7727 to speak with an expert about your investment options and secure your purchase. Alternatively, you can schedule a free consultation to discuss your goals and explore how gold investments can strengthen your financial future. Book now for personalized guidance from our experienced professionals.

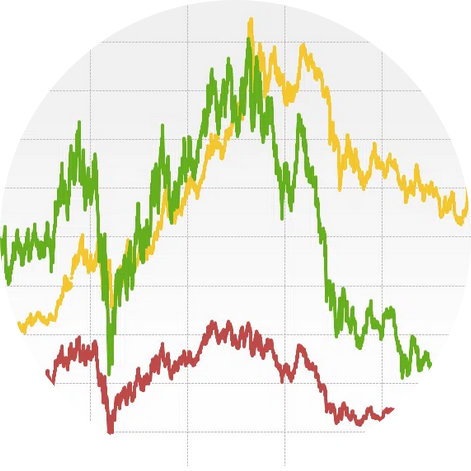

Physical gold has stood the test of time as a secure and stable investment. Unlike paper assets, it is a tangible asset that cannot be devalued or diluted. Physical gold offers protection against inflation, currency devaluation, and market volatility, making it a preferred choice for those seeking a stable store of wealth. By holding physical gold, you safeguard your purchasing power against economic uncertainties.

Gold stocks represent shares in companies involved in mining or processing gold. While they provide a way to gain exposure to gold, they are influenced by the company’s performance and market conditions, making them more volatile than physical gold.

Gold ETFs (Exchange-Traded Funds) allow you to invest in gold without physically holding it. These funds track the price of gold but may not provide the same stability and tangible ownership benefits as physical gold.